A credit score—also known as a CIBIL score or credit rating—is like your financial report card. It shows how well you manage borrowed money. Just like good grades open doors, a good credit score opens doors to lower interest rates on home loans, personal loans and better benefits on financial products.

Your credit score is a number between 300 and 900, with 900 being the best and 300 being the worst. Higher score means you are financially disciplined and uses your money wisely. Lower scores show that you may have had trouble paying bills or loans.

Imagine your credit score as a “trust score” that banks and lenders use to decide if they’ll lend you money.

How Is a Credit Score Assigned?

Your credit score is calculated by top credit bureaus using information like:

Positive financial habits help you get a high CIBIL score or a good credit score.

What Is a Good Credit Score?

Aim for at least 700 credit score for easier and cheaper access to loans and credit cards.

Which Agencies Assign Credit Scores in India?

In India, CIBIL (TransUnion) is the most popular credit rating bureau. Besides CIBIL, credit score is also calculated by Experian, Equifax and CRIF High Mark. These agencies collect your loan and card payment info to provide an up-to-date credit report.

How to Check Your Credit Score in India

It’s smart to check your credit score online at least once a year so you can catch errors or signs of identity theft quickly.

Impact of Credit Score on Financial Transactions

Why should you care about your credit score?

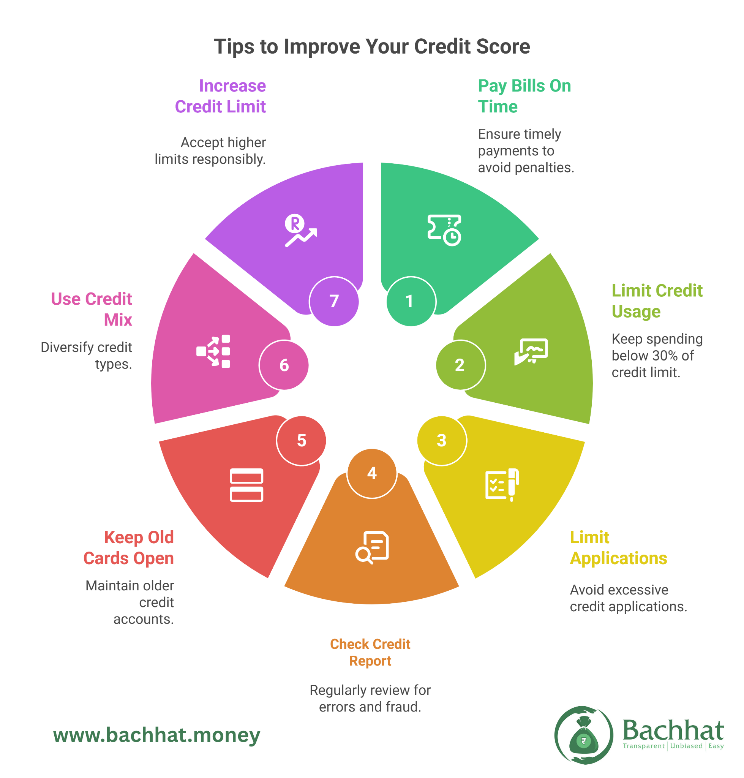

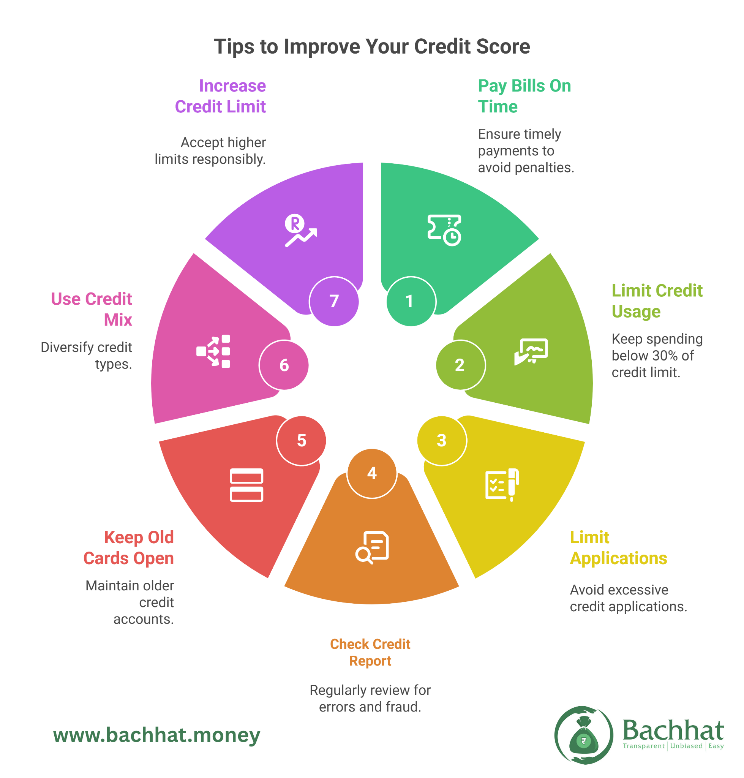

How to Improve Your Credit Score

Even if you’re just starting, here are practical ways to increase your credit score in India:

Always pay your credit card bill and EMIs before the due date. Late payments damage your credit report and CIBIL score.

Try to use less than 30% of your credit limit every month. For example, if your card limit is ₹10,000, try to keep monthly spending below ₹3,000. This helps keep your credit utilization ratio low.

Every time you apply for a new card or loan, it’s called a “hard inquiry,” and too many can lower your score. Only apply for what you need.

Look for mistakes—like loans you never took—or fraud. If you find any, contact the credit bureau to fix them. This keeps your credit history accurate.

An older credit history helps your score, so don’t close your oldest cards unless you have a very good reason.

Having both a credit card and a small loan (handled well) looks good to lenders.

If the bank offers, accept a higher limit but continue to spend responsibly—this improves your utilization ratio if you don’t use the extra.

BachhatTip: Credit Score is generated only if you have a credit history. If you have never used a credit card or never taken a loan, then there will not be any credit score assigned to you which may limit your access to better financial products. Hence it is advisable to take a no-frills, life-time free credit card and use it for your daily household expenses or for ordering food from Zomato and Swiggy. Ensure that you limit your utilisation below 30% of the credit limit and pay the entire dues on time regularly. This will ensure good credit score within matter of months.

Key Takeaways: Why Your Credit Score Matters

You may not need a credit card or loan today, but in the future, your “creditworthiness” will help make dreams—like studying abroad, getting your own car, or buying a home—a reality. Start smart, and your future self will thank you!

By: Vishal Shah, SEBI Registered Investment Advisor and founder of Bachhat

30th July 2025

Disclaimer: This is not a financial advice and the readers should reach out to registered investment advisors for any financial advice. Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investment in securities market are subject to market risks. Read all the related documents carefully before investing.